-

The agency cited falling property rates and US casualty challenges.

-

There may be pain yet to come as claims start to bleed into an underpriced market.

-

Reinsurers are pushing for cat signings and hoping the new pricing floor will hold.

-

Insurance Insider looks at key drivers of supply-demand dynamics in global specialty markets.

-

Tom Wakefield says there is scope for opportunistic reinsurance purchases in 2026.

-

The pricing battle has been played out but the extent of new demand will only show up in 2026.

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Price has become a key differentiator in marine and energy.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

The market is conceding some ground on wordings, after a tightening of conditions post-Ukraine.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

All-risks premium increases are now understood to be in the 15% to 20% range.

-

The chief of market performance urged underwriters not to follow the herd.

-

Despite 2025 losses, carriers have not secured desired rate increases.

-

Willis reports that the mining market has softened at a ‘considerable rate’ this year.

-

The sector also faces a potential $700mn loss from a fatal Indonesian mining catastrophe.

-

Loss activity in the upstream market remains benign, adding to softening.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the downgrade.

-

Executives also agreed that facilitisation is a structural market change.

-

Innovation emerged as the critical target for attracting new business to London.

-

The Aspen exec highlighted the London market’s long-standing reputation for innovation.

-

Patrick Tiernan was addressing 400+ delegates at the London Market Conference.

-

From top-line challenges to finding new ways to scale, 2025 has been a year of market shifts.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The veteran underwriter said market conditions are still ‘robust’.

-

Global pricing is now 22% below the mid-2022 peak.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

The company, however, sets a high bar on making a move.

-

Earnings covers do not need to equal aggregate reinsurance deals, the broker said.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Growth in the SME sector could help stabilize the market, however.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

The ratings agency was presenting its outlook ahead of the Monte Carlo Rendez-Vous.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

The broker said it was achievable to place a $2bn vertical limit in the London market.

-

This is the first rate filing to use the recently approved Verisk model.

-

As rate reductions present headwinds, firms are expected to moderate expansion.

-

The carrier booked top-line growth of 2% in H1.

-

Rates were down 3.9% across its portfolio in the first half of 2025.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

The broker said that there could be a flattening of rate decreases in the hull market in 2026.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

Sources said the downstream energy market is unlikely to turn a profit in 2025.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

The soft market continued through H1 2025, especially on shared programs.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

Premium rose across the top 15 P&C risks in 2024.

-

Is the ransomware threat really getting worse – or just more visible?

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

The Beazley CUO said geopolitics would determine cyber market pricing.

-

Coverage has broadened while limits have increased, the broker said.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

The change reflects the company’s growing profile within the MS&AD group.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

The CUO noted that market-wide rate change in Q1 was down 3.3%, coming in below plan.

-

Soft conditions have led to “less acute" underwriting discipline, sources said.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

The executive criticised the ongoing underrepresentation of women in senior leadership roles.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

The carrier reported a 3% price reduction across London market business.

-

The broker said the burgeoning class of business was still finding its stride.

-

CEO Adrian Cox said the market could turn on “unexpected events”.

-

Cyber and property experienced the largest price reductions.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

The only major product line to see rate increases was casualty.

-

California wildfires had ‘little or no impact’ on property cat pricing at April 1, Dean Klisura said.

-

Technical pricing is insufficient in some areas and inflation is biting into margins.

-

Softening in the upstream market has also accelerated beyond expectations.

-

Despite a softening market, carriers still have belief in their profitability, sources said.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

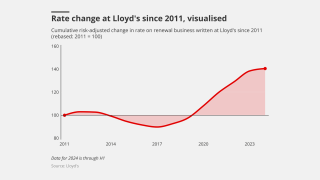

Lloyd’s has been likened to a “toothless tiger” in its crackdown efforts.

-

The rating allows IQUW to access $1bn in group capital.

-

The broker said that businesses not investing in AI capabilities would be left behind.

-

Lloyd’s hopes to protect healthy pricing, but focus is on broader structural market shifts.

-

CUO Rachel Turk said some syndicates were showing a “mismatch” in ambition and strategy.

-

Sources warned of the erosion of underwriting margins after a string of strong years.

-

The combined ratio improved by 0.5 points to 75.7%.

-

The insurance commissioner said the carrier has not shown the need for price increases.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

Guy Carp CEO Dean Klisura said LA wildfires could slow rate reductions at 1 April.

-

Panellists discussed the softening market, and what would flip the switch on rates.

-

Market softening means exploiting hardening niches is the name of the game.

-

It has been a “good” bad renewal for cat reinsurers, with attachments likely to endure in the medium term.

-

In part two of our 2025 outlook, we explore the drivers of carrier M&A and recreating the ESG agenda.

-

Certain new and old themes will re-emerge this year as the balance of power shifts.

-

Supply generally exceeded demand and trading relationships were ‘strong’, CEO Tom Wakefield said.

-

CEO Trevor Carvey said the revision reflected Conduit’s “favourable reception”.

-

Rates are turning negative, and the balance of power is shifting towards the brokers.

-

Aggregates that are featuring in the reinsurance market are not the low-attaching ones of prior years, he added.

-

Annual growth in demand for tax insurance ranged between 25% to 40%, sources said.

-

A resurgence in IPO activity may help provide new business for underwriters and reduce competition.

-

The CEO was responding to comments made by Chubb’s Evan Greenberg.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

The broker is discussing the potential for "smart frequency solutions" with reinsurers.

-

Aon executive Daniele de Bosini said reinforced infrastructure had mitigated the impact of recent disaster events.

-

European property cat rates stabilised and, in some cases, decreased this year following corrections in 2023.

-

Continental cedants are looking for support for third and fourth events.

-

CEO John Doyle said global property rates were down 2% versus flat in Q2.

-

Contrary to expectations that US casualty would dominate the conversations, Milton took the spotlight.

-

Space insurers are running at a near-200% loss ratio after booking losses of over $1bn in 2023.

-

M&A levels have increased 23% year-to-date compared to 2023, according to Gallagher Specialty.

-

Treaty premiums have risen, while casualty premiums remain restrained.

-

Pricing expectations are still not aligned on higher-risk coverage options.

-

Reinsurers are high on their ‘redemption arc’. The question is – how long will it last?

-

The ratings agency said the global reinsurance sector is in “an even stronger position than a year ago”.

-

The rate change will be implemented in November.

-

Property underwriters warn of complacency in how quickly margins can erode.

-

However, some syndicates are planning more significant growth following hires or strategic shifts.

-

Lancashire was the only carrier to see double-digit growth in insurance revenue for H1.

-

The action follows the completed acquisition of Accredited by Onex Partners.

-

The board of directors has voted for a 10% rate hike.

-

In messaging to the market, the cyber insurer described the rating environment as “stable and sustainable”.

-

Q2 was the ninth consecutive quarter of year-over-year price decreases.

-

-

The insurance sector’s RoE is expected to exceed 10% next year.

-

Accounts with poor performance records are expected to see flat to 20% rate increases for cat coverage, according to Floridian broker Brown & Brown’s Q3 Market Trends report.

-

Availability of ILS has so far fulfilled investor demand.

-

Reinsurers were more willing to support lower layers ahead of 1 July, the broker said.

-

The broker said another strong year would drive pressure for “reasonably significant rate reductions” next year.

-

Mid-sized 2023-24 cat losses versus ready capacity held the market in equilibrium.

-

Challenges such as climate change and civil litigation remain troubling.

-

The ratings agency noted robust profit margins for reinsurers.

-

Self-insurance has taken $25bn more premium out of the market than five years ago.

-

The hard market has not burst the MGA bubble – and now interest is on the rise again.

-

From here on out, insurers will likely have to rely on the strength of their individual stories.

-

Prices for programs that renewed in both Q1 2023 and Q1 2024 decreased 15%.

-

Transatlantic competition, rising valuations and price undercutting set a challenging scene.

-

Retentions and coverage could be affected by future adverse claims trends.

-

The Corporation is walking a tightrope between encouraging further growth whilst maintaining discipline.

-

The executive said that adequate rates were encouraging insurers to grow.

-

Attention is fixed on how competition will impact pricing in H2.

-

Underwriters are pushing for rate rises, but competition is increasing.

-

The broker said softening was emerging in some lines, but cat risks remain challenging.

-

Falling rates in finpro and increased competition in property drove the trend.

-

The ratings agency also affirmed the reinsurer’s A- FSR rating.

-

Property rate increases decelerated to 6% in Q4, compared to slowdowns of 7% in Q3 and 10% in Q2 2023.

-

Sources said that the market was not sufficiently profitable to concede ground on pricing.

-

The flight of reinsurers to mid- and upper layers of programmes is influenced by recent experience but softening at this level can be seen as a risky move.

-

European rates on line increased by 7.60%, while in the US prices were up 5.25%.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

The broker said over-placement on some deals was a positive sign for brokers, though reinsurance capacity is still very tight in some areas.

-

Reinsurers are making some adjustments to secure target signings but appetite to grow is finely balanced.

-

Sources said that there was still rating adequacy in the market, but that further pricing falls would be unsustainable.

-

Anticipations of a tug-of-war around a ‘flat to slightly up’ pricing renewal have indeed come to fruition.

-

Profits are expected to widen thanks to improved rates and higher average attachment points.

-

Delegates at our annual London Market Conference (LMC) described the market as “transforming” and “exciting”.

-

The revision reflects Swiss Re's "strongly improved financial performance and better capitalisation and leverage”, the ratings agency said.

-

Does one party – the carrier or the cedant – have to lose out for the other to succeed?

-

London’s insurance market is booming in some ways yet still has multiple challenges to address.

-

The ratings agency said the change reflected its expectation that the carrier would post improving underwriting results in the next two years.

-

The mood at the association’s annual meeting is vastly more congenial this year, but challenges remain, particularly around long-tail lines.

-

With US third-quarter reporting season being well underway, the results so far highlight further runway for the hard property E&S market.

-

The revised status follows the recent announcement that R&Q Insurance Holdings has agreed a sale of its Accredited program.

-

E+S Rück said that natural disasters and persistently high inflation have again "taken a toll" on the German insurance industry.

-

Loss severity and prior-year development in US casualty dominated discussion at The Broadmoor.

-

The Corporation used its latest market message to call out what it saw as an “underwhelming” approach from specialty insurers to changing conditions and “moronic” D&O underwriting.

-

The paradox of “the best reinsurance market in years” is that there are still question marks over who wants a piece of it.

-

The executive also recommitted Aon to its mission around creating net new markets – including growing IP – in the wake of the Vesttoo issues.

-

Despite a successful upstreaming of cat risk to primary insurers, reinsurers still have multiple factors to worry about in the run-up to 1 January 2024.

-

Key trends the credit agencies will be monitoring include inflation, redistribution of losses and the investment bounce-back.

-

The ratings agency also affirmed Swiss Re’s ‘AA-’ rating, with the carrier expected to maintain an ‘AA-’ rating through 2024.

-

Ongoing rate rises in property are expected to be offset by decreases in specialty lines and casualty.

-

The hammering of hailstorm losses that US homeowners’ carriers reported for H1 will drive positive change in property markets.

-

The broker said that rates were largely flat thanks to insurer appetite and competition.

-

Loss-free accounts were generally up 20%-50% at renewal, the reinsurance broker said.

-

A “little flurry” of new capacity helped the mid-year renewals as reinsurers pushed to deploy at the last chance for 2023.

-

Reinsurers began relaxing limits on US property exclusions, but the lack of new start-ups points towards stability amid a more orderly market, the broker forecast.

-

Despite reinsurers’ concerns over social inflation and loss trends, capacity remains abundant in both quota share and XoL deals, sources say.