-

The insurer will be a cornerstone investor in the manager’s new PE platform.

-

The MGA platform has launched more than 20 new vehicles since 2021.

-

What is the strategic thinking behind The Fidelis Partnership’s unique business model?

-

EQT, PAI and Stone Point were involved in early bidding for the asset.

-

The fund has signed up Oliver Hemsley and Peter Montanaro to its board.

-

Ackman targets high-teens ROE at Vantage via underwriting gains and equity investing.

-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

Transactions reveal the attractiveness of the "underwriting plus" business model.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The broker said the A$45-per-share price discussed valued the firm appropriately.

-

The business was founded last year by former Beazley underwriter Richard Young.

-

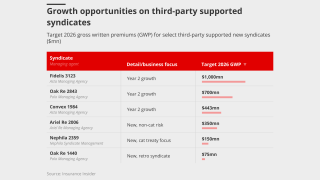

Several PE-backed syndicates were recently sold, but some of the fastest-growing businesses remain up for grabs.

-

From top-line challenges to finding new ways to scale, 2025 has been a year of market shifts.

-

The transaction is Davies’ largest strategic M&A addition to date.

-

The hedge fund had significant investment aims for the London market.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The federation, FASE, aims to connect all participants to provide a voice for European MGAs.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Under the terms of the offer, shareholders would receive A$45 for each AUB share.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.

-

The executive is charged with defrauding investors out of nearly $500mn.