-

The organisation is the UK’s oldest continuously active military charity.

-

The proportion of freehold capacity for 2026 is up by 35% to £218mn.

-

Zurich’s interest in a specialty carrier that moves the dial on cyber is no surprise.

-

Following on from Part I, we look at the hazards to navigate in building internationally from Lloyd’s.

-

Lloyd's said Jim Bichard's experience included advice on innovative capital structures.

-

Plus, the latest people moves and all the top news of the week.

-

Chaucer and Beazley are among the syndicates looking to take on new geographies.

-

The Corporation ranked in the bottom quartile in last year’s survey.

-

The facility is backed by a consortium including Arch, Munich Re Specialty and Scor.

-

Plus, the latest people moves and all the top news of the week.

-

Jen Tan was most recently head of portfolio strategy.

-

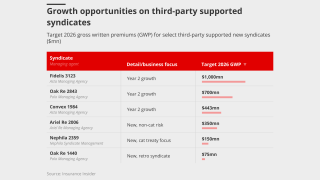

What is the strategic thinking behind The Fidelis Partnership’s unique business model?

-

Almost 90% of respondents felt they could be themselves at work.

-

The executive spent a year as Ki Syndicate 1618 active underwriter.

-

The executive is leaving her role as HDI Global UK and Ireland CEO.

-

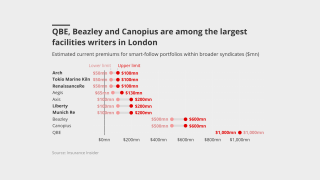

Smart-follow capacity has ballooned but that doesn’t mean key facilities will keep growing.

-

The company will manage Octave-backed syndicates 4242 and 1416.

-

Syndicate 3705 adds to the MGA’s roster of capacity providers.

-

The PVT market saw falling rates and several risk losses during 2025.

-

The executive replaces Andrew Brooks, who served two consecutive terms.

-

Carrier M&A will continue to be a feature, as pressure for returns on AI investment ramps up.

-

Insurance Insider looks at key drivers of supply-demand dynamics in global specialty markets.

-

A roundup of all the news you need, including Tim Cook retiring from his role as head of construction at Apollo.

-

Patel was recognised for services to charity and Riley for business leadership and inclusion

-

Insurance Insider reflects on the themes that shaped 2025 for the London market.

-

K2’s CUO Parth Patel will serve as the SPA’s active underwriter as it was granted permission to underwrite for 1.1.

-

The fund has signed up Oliver Hemsley and Peter Montanaro to its board.

-

The company said the move was a key part of its risk-diversification strategy.

-

Plus, the latest people moves and all the top news of the week.

-

Market sources have also raised the prospect of moving the market beyond bureau reliance.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

What were the defining moments that shaped the insurance market in 2025?

-

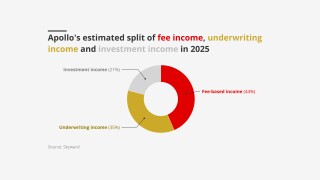

Transactions reveal the attractiveness of the "underwriting plus" business model.

-

Andrew Ealey joined Canopius in 2010 as a property treaty underwriter.

-

The newly created role will have responsibility for algorithmic and digital distribution channels.

-

The six D&I partner networks already derive most of their funding from other sources.

-

Plus, the latest people moves and all the top news of the week.

-

How do you harmonise distribution strategies in a rapidly evolving marketplace?

-

The syndicate will be managed by Polo Managing Agency.

-

Oaktree will fund the syndicate and act as investment manager for its assets.

-

The review found an unrelated breach over the CEO failing to log a journey on a private jet.

-

Plus, the latest people moves and all the top news of the week.

-

One critical sticking point for Lloyd’s is the true alignment of interest with the market.

-

The underwriter has spent 30 years in fine art insurance.

-

The Lloyd’s Market Association (LMA), setting out its “core asks” for 2026, has said it is expecting the market to achieve multiple peer-to-peer technology adoptions next year.

-

The transaction is expected to close early in the first quarter of 2026.

-

Smaller syndicates are lifting their share of the market, as the top quartile also returned to growth.

-

The chief of market performance urged underwriters not to follow the herd.

-

Six of the 10 largest syndicates remained flat or reported de-emptions.

-

Lower rates and currency shifts have pushed syndicates to cut stamp.

-

Nobody likes flying in turbulence, and in recent years aviation insurers have faced their fair share of upheaval.

-

The chief of market performance urged syndicates not to “pull forwards” tougher conditions by chasing topline.

-

The syndicate was launched at Lloyd’s last year.

-

Simon Mason will continue to support the business through the upcoming reinsurance renewals.

-

The system is designed to pay claims faster as well as improving capital efficiency.

-

The association has teamed up with Lloyd’s on a women’s underwriting summit.

-

Plus, the latest people moves and all the top news of the week.

-

The developments this week thrust culture issues up the agenda for new leadership.

-

Sheila Cameron called on Lloyd’s to “accelerate” its commitment to behavioural change.

-

Aegis, Beazley and others are among those cutting stamps.

-

Whether Rebekah Clement's promotion was influenced by an inappropriate relationship is in scope.

-

The Australian insurer is a major cat cedant and had hoped to set up a reinsurance syndicate.

-

At our London conference, executives saw various routes to growth, even as headwinds grow.

-

Sharp will remain for the 2026 renewal process, before pursuing a new opportunity in the market.

-

The syndicate aims to write £80mn of programme business in 2026.

-

Several PE-backed syndicates were recently sold, but some of the fastest-growing businesses remain up for grabs.

-

Apollo CEO David Ibeson was also in the running for a seat on Council.

-

Plus, the latest people moves and all the top news of the week.

-

Innovation emerged as the critical target for attracting new business to London.

-

What does it take to build a reinsurer that can manage volatility?

-

Panellists said recent M&A has not yet led to transformative change for the market.

-

This publication revealed Volante was in talks with legacy players last month.

-

Patrick Tiernan was addressing 400+ delegates at the London Market Conference.

-

From top-line challenges to finding new ways to scale, 2025 has been a year of market shifts.

-

The move to launch a second syndicate was reported by Insurance Insider in June.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

The hedge fund had significant investment aims for the London market.

-

Plus, the latest people moves and all the top news of the week.

-

The consortium will target excess layers, providing $250mn of capacity.

-

The CEO said smart-follow is a structural evolution of the specialty market.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

Plus, the latest people moves and all the top news of the week.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

The MGU’s second syndicate launch was delayed from January 2025.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

The number of syndicates traded at auction was the highest for a decade.

-

Lloyd’s investment vehicles have been shelved in past years but a strong run of returns is creating interest.

-

Sam Geddes will join Syndicate 1918 next year in an executive leadership role.

-

The company noted tougher market conditions and higher large losses during the year.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

The two lines will add £11mn in planned premium.

-

As two working member vacancies are arising on the Council, a ballot will be held.

-

Plus, the latest people moves and all the top news of the week.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Ark has been adding new product lines across its three Lloyd’s syndicates.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Plus, the latest people moves and all the top news of the week.

-

Incumbent Jane Warren will retire at the end of the year.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The former civil servant joined the Corporation in October 2021.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

Volante launched Syndicate 1699 in 2021.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

Several airlines are understood to have come to market early.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

The Lloyd’s investment business has cut expenses by 54% over the past six months.

-

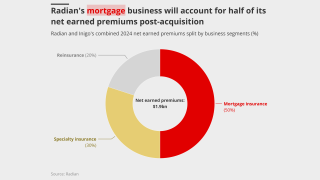

The deal will be watched closely by Radian’s handful of similar peers.

-

The pair hail from Dale Underwriting and Axa XL, respectively.

-

Plus, the latest people moves and all the top news of the week.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The veteran underwriter said market conditions are still ‘robust’.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

Losing senior women creates a knock-on effect as juniors lose role models.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

Inigo executives told Insurance Insider last year they were weighing up the casualty treaty market.

-

The carrier plans to reduce 623’s stamp by around 10% next year.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

The business has ramped up its underwriting volume since launching in Lloyd’s last July.

-

Plus, the latest people moves and all the top news of the week.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

Lloyd’s has pursued a Big Game Hunting strategy to lure major insurers into the market.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Apollo most recently received in-principle approval for Syndicate 1972.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Mark ‘Ollie’ Hollingworth has held his current role at Atrium since 2017.

-

Paul Sandi, head of reinsurance, will serve as active underwriter for the new syndicate.

-

Maintaining underwriting discipline was central to the Corporation's messaging.

-

It was announced this week that the business had agreed to be acquired by Skyward Specialty.

-

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

Rachel Turk said product-line facilities had been “under-scrutinised”.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

The carrier said the decision reflected its commitment to portfolio discipline.

-

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

The cycle-turn M&A story continues with strategic buyers to the fore.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

What happens when a global broker network decides to fill a gap in the London market itself?

-

The news comes after the announcement of CEO Graham Evans’ departure.