RenaissanceRe

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

Plus, the latest people moves and all the top news of the week.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

Improved performance and growing investment returns played a role in the upgrade.

-

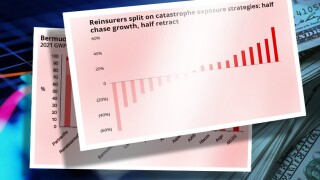

Cat portfolios generally grew, but casualty approaches varied.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

The property segment reported a CoR of 27.4% for the quarter, down 26.5 points year on year.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

Chance Gilliland spent a decade at Chubb underwriting property binders.

-

The firm said supply and demand was becoming more in balance than at 1 January renewals.

-

The property segment experienced a 113.5-point impact from the California wildfires.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

Deteriorating CoRs, GWP growth and fears over wildfire impacts were common themes.

-

The reinsurer is ready to deploy additional capacity following the event, but only if prices are commensurate with risk.

-

Hurricane Milton brought the firm net losses of $270mn in Q4, while it forecast up to a $750mn wildfire hit for Q1.

-

The reinsurer tends to support a number of syndicates where it has a potential relationship.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

Hurricane Milton is estimated to have a net negative impact of $275mn on Q4 results.

-

Everest Re bucked a more general trend to keep cat exposure stable.

-

The property market remains “one of the most favourable... I've seen in my career", he said.

-

The property CoR improved by 9.1 points, while casualty and specialty’s fell 5 points.

-

The specialty treaty market is preparing to deal with the fallout from the Baltimore bridge disaster.

-

The Bermudian has been reducing exposure in Florida for almost a decade.

-

The property CoR improved by 13.7 points, while casualty and specialty’s deteriorated by 6.7 points.

-

The 100% equity award will vest in full after five years.

-

Sven Wehmeyer, Jodie Arkell, Hugh Brennan and Ed Cruttenden have new roles.

-

Strong reinsurance results have absorbed long-tail reserve charges.

-

The initial plan was to renew $2.7bn of the acquired book.

-

This was RenRe’s first set of quarterly results after its takeover of Validus.

-

The segment has bounced back from its mid-2022 nadir, but its current zenith is not that much to shout home about.

-

Additional disclosure following the RenRe acquisition reveals results for both carriers for the nine months to 30 September last year.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

Other senior executives, including CFO Robert Qutub and general counsel Shannon Bender, received stock awards of $750,000 for their involvement in the Validus Re acquisition.

-

The number of staff retained contrasted with more dramatic cuts made after the acquisition of Tokio Millennium and Platinum.

-

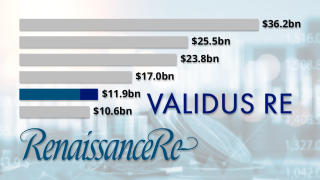

After moving into the rank of fifth-largest reinsurer, following its acquisition of Validus, RenRe said it would continue to take a leading role in the regional cat space and expected to be more able to trade through market cycles.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The Bermudian also disclosed that it raised $16.3mn of third-party capital in Medici during the quarter.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

The Bermudian’s global property CUO and European chief says it is ready to expand if conditions remain favourable.

-

The reinsurer said it was monitoring conditions in the property E&S markets, where it has been reducing capacity to grow in property treaty, as rate gains could provide fertile ground for future growth.

-

Large loss events resulted in a net negative impact of $68.5mn on the property segment’s Q2 underwriting results.

-

The reaction to capital raising this year signals that investor belief in risk-takers is reinvigorated.

-

RenaissanceRe has said it hopes to retain as much as 90% of the Validus Re portfolio, but where are the highest areas of overlap by cedant?

-

Morgan Stanley and Golman Sachs exercised in full their right to buy 945,000 shares in the company.

-

The carrier intends to use the cash raised as part of its consideration for Validus.

-

The deal is the third scale-up buyout for the firm, highlighting the ongoing value of scale in the reinsurance segment.

-

The deal is not predicted to have a long-term impact on RenRe’s financial leverage, AM Best said.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

The deal represents RenRe’s third Bermuda consolidation deal following Platinum and TMR.

-

The CEO said the reinsurer has already written some private deals ahead of the June 1 deadline and expects to continue a pivot away from E&S in favour of property cat reinsurance.

-

The segment reported a 13.5-point improvement in its CoR to 56.5%, while maintaining a 14.6% growth in net written premiums.

-

The executive will stand for election at RenRe’s AGM in May.

-

The January 1 renewal for 2023 was “one of the most profound” the company has ever had, the CEO said.

-

The Bermudian also raised third-party capital of $402.9mn effective January 1, 2023, including $377.2mn in DaVinci and the remaining in Medici.

-

The world’s largest investment company has assets under management of more than $10tn.

-

The firm elevated Justin O'Keefe, Cathal Carr, Fiona Walden and Bryan Dalton to US and Bermuda, Europe, casualty & specialty, and property CUOs, respectively.

-

The executive will continue to lead climate and sustainability underwriting initiatives in addition to his new role.

-

The RenRe vehicle, formerly a major retro writer, has been a reduced force this year.

-

The reinsurer is ready to “walk away from business” where it feels pricing and terms and conditions are not good enough.

-

The Bermudian reinsurer said both appointments are effective January 1, 2023.

-

A 3.9-point decline in the casualty and specialty segment offset a 2.5-point deterioration in the company’s property business.

-

The estimate is driven by $540mn of losses attributable to Hurricane Ian.

-

This publication’s review of H1 disclosures shows how listed (re)insurers’ nat cat losses have tallied with aggregate projections.

-

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.

-

The carrier said increased demand should maintain upward rate pressure at January 1.

-

The company’s property segment booked a combined ratio of 57.6%, 13.8 points higher compared to Q2 2021 due to a higher attritional loss ratio.

-

RenaissanceRe has always been a business with strong convictions and an assured management team, willing to carve out a path distinct from competitors.

-

Sudhir Modhvadia will be based in London and report to head of facultative Alex Shepherd.

-

RenaissanceRe CEO Kevin O’Donnell explained on an earnings call his take on the mid-year renewals and a relatively low impact of the Ukraine war.

-

The firm reported that net claims and claims expenses incurred related to the invasion had a $27.1mn negative impact in the casualty and specialty segment.

-

Fontana investors will face a short lock-up period in the sidecar’s ramp-up phase, but thereafter there will be some “embedded liquidity.”

-

The new platform extends RenRe’s suite of ILS and reinsurance strategies.

-

The carrier has introduced a number of ESG-focused roles, which sees Cathal Carr, SVP, underwriting, appointed as global head of climate and sustainability strategy.

-

Executive pay at RenaissanceRe fell for the second year in a row in 2021 after a “disappointing” return for shareholders in a year of elevated natural catastrophes.

-

Carr was previously SVP, global head of property catastrophe at the reinsurer.

-

RenaissanceRe has nominated Shyam Gidumal to its board, while Jean Hamilton is set to retire from the board in May 2022.

-

RenaissanceRe had raised $470mn for the high-risk fund platform a year earlier.

-

The move has emerged after Axa XL and Hamilton took decisions to move reinsurance books out of Lloyd’s.

-

Kevin O’Donnell also said 1.5-point rises in ceding commissions for long-tail line treaties were an “acceptable” increase in acquisition costs, given improved underlying profitability.

-

Casualty premiums grew 48% and the company raised $663mn in new capital for its alternative capital vehicles.

-

The executive said social inflation, fraud, and other loss drivers have driven up the cost of storms, and contributed to model miss.

-

The reinsurer grew GWP by 55% – to $1.77bn – helped by a surge in reinstatement premiums, but the company was weighed down by $727mn in net cat claims.

-

The figure – which included $440mn in losses from Hurricane Ida and $210mn from severe flooding in Europe – exceeds the $617mn in claims in the third quarter of 2017.

-

From ESG to social inflation, systemic risk to cat risk, we highlight some of the top discussions from this year’s four-day virtual conference.

-

The RenRe CEO attributed the company’s success with third-party capital to making sure new vehicles meet client demands.

-

The reinsurer has been reducing its exposure to domestic companies since 2019.

-

RenRe CEO Kevin O’Donnell said cyber reinsurance rates were two fifths higher in Q2 than during the same period last year.

-

RenRe beats estimates with $329mn underwriting income driven by a surge of profits in its property segment.

-

New and growing carriers helped to fill out treaties as Sompo stepped back from a market that came in flatter than expected for remote risk.

-

The executive also indicated that the reinsurer would be willing to grow at the Florida, if pricing reached what it viewed as adequate levels.

-

The reinsurer grew premiums by 31% in the quarter overall, led by a 33% pickup in property premiums and 29% growth in casualty and specialty.

-

Last year, RenRe reported an operating profit of $33mn in Q1 due to Covid-19 losses.

-

The division had been led by group CEO Kevin O’Donnell on an interim basis following Aditya Dutt’s departure.

-

Competition has ramped up over the last two years and now represents a threat to returns.

-

The move follows Fidelis’ decision to hand back $275mn it had raised for a retro vehicle.

-

Further Covid losses, core loss ratio improvements, reserving and the duration of the cycle are key themes emerging from the reporting season.

-

O’Donnell noted that the Bermudian has enjoyed the fruits of a “materially improving market” during January 1 renewals.

-

RenRe said it had “ample dry powder” even after fully deploying its $1.1bn 2020 capital raise.

-

The additional $730mn in capital for its Upsilon RFO, DaVinci and Medici funds include $130mn of the company’s own money.

-

The reinsurer anticipates a $175mn hit from Covid-19 claims during the quarter.

-

The move comes as environmental policies move up the list of investor priorities.

-

He is replaced in the role by Shannon Lowry Bender, who starts work on 1 January next year.

-

The syndicate has a £651mn stamp for 2021 as it looks to redeploy growth capital released from a recent adverse development cover.

-

CEO Kevin O'Donnell said climate change was driving increases in cat loss frequency.

-

Axis, RenRe, Arch and Everest Re trade roughly in line with the S&P 500.

-

The Bermuda carrier will be an initial investor in Griffin Highline.

-

The CEO says recent trends are affirming the assumptions made before the carrier’s $1bn equity raise.

-

The reinsurer’s combined ratio improved to 78.5% from 81.3% in the prior year quarter.

-

The former RenRe third-party capital chief joins the Bermudian ILS firm.

-

The executive played a key management role in a group that has raised more than $1bn in the last year.

-

This comes after Everest Re previously let a mid-year renewal lapse, with ILS capacity scarce.

-

The shares change hands at a 0.6 percent premium to the undisturbed price, though more than 5 percent below Tuesday's close.

-

Shares in the carrier rise more than 4 percent in the New York morning.

-

Shares in the insurers rose higher than the broader market as states move toward cautiously reopening their economies.

-

O’Donnell argued that market uncertainty about the breadth and depth of Covid-19 losses will reduce risk appetite and constrain the reinsurance supply.

-

The reinsurer’s specialty book was hit with $104mn in coronavirus-related claims during the quarter.

-

Ed Cruttenden will take on the role as Bryan Dalton becomes CUO for the Bermuda carrier’s European operations.

-

The new funds raised at 1 January are dedicated to its retro-focused Upsilon fund and its Medici cat bond strategy.

-

The carrier reported an underwriting loss of $65.2mn for the quarter, slightly better than in the prior-year period.

-

Gross reserves related to the former Tokio Millennium Re book were £160mn in September.

-

The reinsurance partnership would support the expansion of Beazley’s fast-growing affirmative cyber book.

-

A lower catastrophe burden buoys group profit but anticipated reserved strengthening prompts it to trim its full-year forecast.

-

The sector will see a slight dip in capital at the upcoming renewals, but growth prospects are strong, panellists at an S&P conference predict.

-

O'Donnell said the market is “missing the point” about the dangers of climate change.

-

The Bermudian company wrote 70 percent more casualty and specialty premium year on year.

-

The reinsurer expects to take a $100mn charge from Faxai and assume $55mn of Dorian liabilities.

-

The RenRe CEO raised the concern in light of the way catastrophe losses have risen from initial estimates in recent years.

-

Tatsuhiko ‘Tats’ Hoshina led Tokio Millennium Re for 14 years and becomes the 11th member of the advisory board.

-

Kinesis deployed 50 percent more limit year on year while RenaissanceRe grew its DaVinci sidecar.

-

Half of the $700mn capital raise was allocated to DaVinci “based on opportunities arising from organic growth”, he said.

-

The reinsurer beat estimates of $3.71 per share and reported raising $700mn in capital through third-party vehicles.

-

Alex Shepherd joins from the role of property head at Syndicate 1458.

-

The ILS market faces a test to recover position as it loses market share to traditional players.

-

The underwriter moves following the completion of RenRe’s takeover of the Tokio Marine unit.

-

The Japanese carrier says loss derives mainly from an appreciation in the value of the yen since TMR’s launch in 2000.

-

About 46 percent of shareholders disapproved of O’Donnell’s compensation in a non-binding advisory vote.

-

First-quarter combined ratios deteriorated at most Bermuda-based (re)insurers.

-

The reinsurer, now owned by RenaissanceRe, had reported a loss of $158.8mn in 2017.

-

Reinsurers recognize the need for more rate for the risk being ceded, O’Donnell said on the firm’s Q1 call.

-

The Bermudian (re)insurer posted a combined ratio of 72 percent in Q1 2019, a 1.4 percentage point increase year on year.

-

Cunningham is the latest TMR underwriter to resurface in the industry.

-

Nine broking houses made it to the ranking this year versus 54 underwriting firms.

-

The second edition of the survey generated a ranking of 227 reinsurance professionals

-

David Martin will report to deputy global reinsurance head Matthew Wilken.

-

After Hurricane Katrina, a slew of big composite insurers including Axa and Chubb spun off their reinsurance arms, citing their excessive volatility.

-

The firm’s moves to add new pools of risk will not extend to a major shift into primary lines.

-

The blockbuster $1.5bn deal grows RenRe to a $3.9bn-premium reinsurer.

-

Much of the executive team is leaving as the firm’s $1.5bn sale to RenRe nears close.

-

Nephila, RenRe and Validus go on the record with this publication on the forthcoming 1 June renewals.

-

Aside from the noise around elevated catastrophes and lacklustre renewals, Q4 underlying loss ratios continued to rise.

-

As activist investor Voce Capital Management becomes the carrier’s fourth-largest shareholder, this publication explores what incentive the investor has to push for a sale.

-

At the midpoint of disclosures, this publication summarises the key trends identified by industry leaders so far.

-

Few of the Bermuda and London staff at Tokio Millennium Re will be retained after the takeover.

-

There will be a reduction in the amount of third party capital in the industry this year, O’Donnell told analysts.

-

RenaissanceRe beat analyst consensus by turning an operating profit despite posting an underwriting loss of for the final quarter of 2018.

-

The Willis Re executive said 2019 could be a challenging year for some ILS managers, as some products have performed poorly.

-

The vehicle will target the upper layers of US property catastrophe cover.

-

About four-fifths of stocks in the index decline and none manages gains of more than 1 percent.

-

Casualty reinsurers looking to continue positive pricing movements seen in 2018 renewals.

-

The California State Compensation Insurance Fund returned to the cat bond market as USAA’s ResRe multi-peril deal raised $200mn.

-

Above-average cat losses dominate discussions during the P&C earnings season.

-

The credit agreement went into effect on 9 November.

-

Analyst predicts Chubb and Travelers could also pick up $400mn if industry insured losses hit $10bn.

-

Reputation can still be an underrated commodity in insurance.

-

Carriers disclose heavy cat losses as well as mixed underlying performances, as business mix shift continues.

-

Casualty pricing and demand overshadow property catastrophe, while RenRe arrives just too late to steal the show.

-

Deal adds scale and operating leverage for the Bermudian at an attractive price.

-

The deal also accelerates a strategy of pursuing increased scale and leverage.

-

The Insider 50 reached 1,103.1 index points last week as all sub-groups in the index post gains.

-

The change aligns its ratings with those of purchaser RenaissanceRe

-

Before Florence and Michael, rate reductions had looked set to resume.

-

Other businesses with reinsurance exposure like TMK, Tokio Marine HCC and Safety National remain core.

-

Meanwhile, Fitch affirmed the reinsurer’s financial strength rating at A+ with a stable outlook.

-

More than 4,000 new claims were filed to the insurer in the third quarter.

-

Why would a patient Japanese owner spend 18 years building a diversified reinsurer from scratch then discard it for a bargain price?

-

Acquirer will also substantially shrink the portfolio and use third-party capital to support the book.

-

The $1.5bn takeover agreement diminishes the chances RenRe itself will become a bid target.

-

RenRe said the deal was additive to its existing platform and will be financially accretive for shareholders.

-

The TMR deal will act as an effective poison pill to any would-be acquirer.

-

The deal makes RenRe the fourth-largest Bermuda reinsurer and gives it significant clout as a fronting provider for ILS managers.

-

The Bermuda-based reinsurer’s high net investment income offset its loss on underwriting.

-

The reinsurer turns buyer rather than seller after facing pressure from an activist investor to consider a sale.

-

Although estimates for the Q3 disasters vary, in aggregate the events are likely to generate insured losses north of $10bn.

-

Almost two-thirds of the losses are expected to stem from homeowners’ claims.

-

The Bermudian is facing $155mn of Q3 cat claims, and shareholders can expect “modest net income” when the company posts its results for the period.

-

Reinsurers now have fresh impetus to argue for flat renewals at 1 January.

-

Michael losses are likely to fall on the reinsurance market due to the low attachment points of the Floridian homeowners’ insurers.

-

The Insider 50 rose 0.5 percent last week to reach 1,155.8 index points.

-

Holding an asset because you think someone else will ultimately buy it from you at a higher price is called a “greater fool” thesis.

-

The firm’s strength as an alternative capital provider may prove a lure, analysts say.

-

The Bermudian carrier has come under pressure from activist investor TimesSquare Capital to take advantage of market consolidation.

-

The investor claims various potential acquirers would "covet" the Kevin O'Donnell-led reinsurer.

-

Validus, Nephila and Everest lead reinsurers providing Irma payouts to Citizens.

-

The German reinsurer’s gross written premium rose to $37.8bn to reclaim the top spot in AM Best’s rankings.

-

The Cal Phoenix Re cat bond was the first cat bond to cover wildfire on a standalone peril, as well as the first third-party liability issuance.

-

Property cat reinsurance rate rises still lag behind those of primary insurance, executives said during Q2 conference calls.

-

Other similar types of platform in the Bermudian (re)insurer’s portfolio have also grown.

-

The Insider 50 grew by 1.5 percent last week, with all but 13 companies in the index posting a gain in their share prices.

-

The reinsurer’s CEO declared it “the best market we have seen in years”.

-

The reinsurer’s combined ratio improves as estimates of 2017 cat costs decline.

-

While reinsurers are benefiting from low cats, pricing fundamentals remain weak.

-

There were positive share price changes over the quarter from only 13 companies in the index.

-

The total for the year stands at $798.56mn.

-

Underwriting opportunities become the focus in Q4 2017 and Q1 2018.

-

The key to working together relies on developing symbiotic relationships, CEO Maffeo says.

-

The executive will focus on retrocessional property catastrophe business at the Bermuda company.

-

The investment yield for Bermudians remained low for 2017, averaging 3.1 percent.

-

The insurer now has reinsurance for up to $3bn of losses from a Florida hurricane.

-

RenRe’s capital infusion is expected to fuel growth by the expansive broker.

-

Bermuda gross written premium increased by 20 percent to $15.0bn in Q1 2018.

-

The Nephila-led reinsurance facility provides three years of cover.

-

Early signs indicate third-party capital is being deployed aggressively in the Florida market.

-

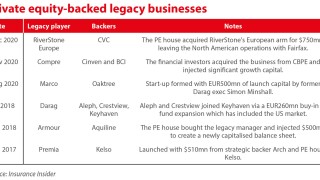

The legacy sector has seen surging deal volumes of late, but the major inflows of capital into the space look set to choke off returns, with the live market’s depressed returns a cautionary tale for run-off acquirers.