-

The agency cited falling property rates and US casualty challenges.

-

The reinsurance broker will be known as Marsh Re starting in 2027 as part of a broader company shift.

-

Sources said they expected FM to keep around $2bn of the maximum line net.

-

The carrier has also promoted Jamie Pedro to head of specialty re, Bermuda.

-

Philipp Rüede succeeds François de Varenne, who will become senior advisor to the CEO.

-

The specialty reinsurance market is experiencing high competition and staff turnover.

-

Barry Gale has spent almost five years at the broker.

-

The LA wildfires resulted in the largest insured loss of the year, at $40bn.

-

The 25-year industry veteran will report directly to CEO Adrian Daws.

-

Fresh from a deal with QBE Re, the investment firm discusses drivers of casualty ILS growth.

-

The report emphasises the need for clarity around roles and responsibilities.

-

Plus, the latest people moves and all the top news of the week.

-

Almost 90% of respondents felt they could be themselves at work.

-

The executive spent a year as Ki Syndicate 1618 active underwriter.

-

The executive is leaving her role as HDI Global UK and Ireland CEO.

-

The sidecar has backing from Culpeper Capital Partners, Calidris Investment Partners and Compre.

-

The move comes after a 200+ person mass team lift from Brown & Brown’s retail business in the US.

-

The renewal was characterised by abundant capacity and strong competition.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

Patel was recognised for services to charity and Riley for business leadership and inclusion

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

Insurance Insider reflects on the themes that shaped 2025 for the London market.

-

Cedants are opting to bank double-digit savings as reinsurers fight for market share.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

The market is conceding some ground on wordings, after a tightening of conditions post-Ukraine.

-

Plus, the latest people moves and all the top news of the week.

-

The company named two execs to head global wholesale and commercial.

-

The facility provides solvency support via a fresh equity injection under various scenarios.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

Nick Hankin replaces Chris Killourhy, who is becoming group CFO.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The market is “extremely competitive”, with several launces from MGAs and syndicates expected.

-

The group aims for earnings per share growth of more than 8%.

-

The highest portion of losses was experienced in Alberta.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

Expectations that reductions would cap out at low double digits are fading due to capacity oversupply.

-

The deal adds a forward-flow, giving Compre the option to reinsure additional future years.

-

The CEO conceded some might see Swiss Re’s dividend targets for 2026 as “underwhelming”.

-

The reinsurer’s “refreshed” strategy to focus on AI and a new share-buyback programme.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

The company had argued the judge missed key info when dismissing the case.

-

China Taiping has been identified as the building owner’s insurer.

-

The reinsurer is offering pricing incentives to members to reintegrate cover.

-

In mid-morning training, the share price had fallen by 12%.

-

In this final instalment, we argue that investing in personnel is as critical to success as the tech itself.

-

Call for public and private partnership in cyber are not new, but sentiment remains divided.

-

The peril has been historically difficult to model compared to others.

-

Habayeb will start next May following Kociancic's retirement.

-

After a challenging period, the industry is now earning above its cost of capital.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

David Croom-Johnson will now focus exclusively on CEO duties.

-

The reinsurer said discipline was now “equally important as price”.

-

The reinsurer is “well on track” to achieve $4.4bn in net income for the full year.

-

The executive said that outside of property cat, renewals will be “relatively stable”.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

Rohan Davies joined Markel International 17 years ago as an underwriter.

-

P&C GWP grew by 7.1% to EUR26.8bn over the period.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The group raised its full-year net income guidance to EUR2.6bn.

-

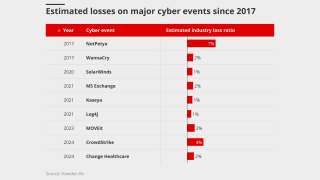

Specialised service providers like CDK can pose more frequency risk than global operators.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

On a net basis, premiums written were up 4.7% to $641.3mn.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The June 2024 ransomware attack produced claims across many firms.

-

Industry-wide initiatives continue to target expanded youth access to the sector.

-

The carrier’s retail division saw premiums increase by 7.3% to $2bn.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Widespread underinsurance and low exposures will limit losses.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The Spanish (re)insurer reported a group net profit of EUR829mn.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

Jason Keen joined Everest in 2022 as head of international.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

This publication revealed the move earlier this year.

-

Plus, the latest people moves and all the top news of the week.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

The change forms part of a broader leadership reorganisation.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

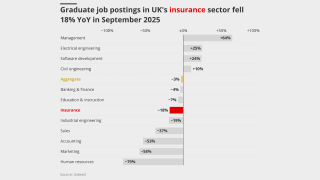

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Class actions and third-party litigation funding will drive up losses.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

In July, he took the role on interim basis from Laure Forgeron.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The carrier will pay special dividends only in exceptional circumstances.

-

Plus, the latest people moves and all the top news of the week.

-

The facility will initially focus on US, Bermudian and European business.

-

Stephen Ridgers is leaving his current role as head of construction midcorp at Allianz Commercial.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

The deal will be watched closely by Radian’s handful of similar peers.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

Louis Tucker helped establish Barbican Insurance, which was later sold to Arch in 2019.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The sidecar will support five programs providing specialty frequency coverages.

-

The assistant treasurer is also due to review the Australian cyclone pool.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The platform aims to “bend the loss curve”.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.