-

Last year was the ninth-largest loss year for the country on record.

-

The year featured the fewest multi-billion-dollar insured loss events since 2019.

-

The market expects a lower proportion of restoration by utilities than after 2018’s Camp Fire.

-

The storm is expected to bring freezing rain and heavy snow across a wide swath of the US.

-

Increased vegetation could spell trouble in the future.

-

Sources said they expected FM to keep around $2bn of the maximum line net.

-

The multi-line program seeks to support investors, developers and operators involved in the AI boom.

-

The LA wildfires resulted in the largest insured loss of the year, at $40bn.

-

The 25-year industry veteran will report directly to CEO Adrian Daws.

-

The property insurer has secured significant additional capacity for its FM Intellium unit.

-

Weather events and potential increases in US casualty reserves remain sources of volatility.

-

The move comes after a 200+ person mass team lift from Brown & Brown’s retail business in the US.

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Price has become a key differentiator in marine and energy.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The company named two execs to head global wholesale and commercial.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The mechanism would work similarly to Flood Re.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

The underwriter will fill a newly created role at AIG.

-

Join senior market leaders for a forward-looking discussion on performance trends, pricing dynamics, M&A signals and risk appetite across both admitted and E&S segments.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

The MGA began offering US commercial E&S property products in December.

-

The carrier now expects to deliver full-year operating profit of ~£2.2bn.

-

James Kelly joins from Besso, having held senior positions at JLT, Lockton and Gallagher.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

APIP is one of the world’s largest property programs.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Brian Church has spent 20 years at Chubb.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

Declared events totalling just under A$2bn ($1.3bn) included one cyclone and two floods.

-

Julia Graham played a key role in the UK's introduction of captive-friendly regulation.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

The pair have expanded remits overseeing property and specialty.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The underwriter has worked at Hiscox, Lloyd’s, Chubb and Zurich.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The executive met with UK colleagues to discuss plans for the US business.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The platform aims to “bend the loss curve”.

-

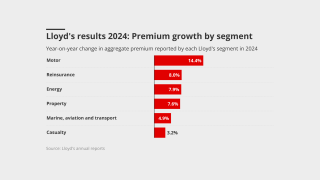

The sector recorded total premiums written in London of £11.9bn in 2024

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Mark ‘Ollie’ Hollingworth has held his current role at Atrium since 2017.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The executive most recently served as head of North American treaty reinsurance.

-

The data modeling firm said losses previously averaged $132bn annually.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

The combined ratio worsened slightly by 0.5 points to 91.6%.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

Nat-cat events triggered A$1.36bn of losses during the year.

-

Company alum David Murie will lead the new business unit.

-

The carrier’s profit grew 34% for the year to A$1.35bn.

-

Layla O’Reilly and Mark Edwards are among the brokers leaving the firm.

-

The estimate covers property and vehicle claims.

-

The Hannover Re CEO said rate adequacy remains “attractive” overall.

-

California wildfires were the reinsurer’s largest H1 loss, at EUR615.1mn.

-

Both organisations still predict an above-average hurricane season.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

The P&C re segment’s combined ratio improved by 12.7 points to 61.0%.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

CEO Alex Maloney said Lancashire’s growth was “more measured” amid softening.

-

Natural catastrophe claims remained consistent compared with the prior year.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The company has also expanded its relationships with US and UK MGAs.

-

Matthew Doherty joined the reinsurer in 2018 as SVP, property portfolio manager.

-

The Canadian insurer saw property rates dip across its global divisions.

-

The business posted a 95.2% undiscounted combined ratio.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

The P&C segment posted an 82.5% combined ratio for the quarter.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Group CEO Tavaziva Madzinga said it might explore Lloyd’s Names backing in the future.

-

Property rates declined by 7% globally in the second quarter.

-

The property segment reported a CoR of 27.4% for the quarter, down 26.5 points year on year.

-

Liberty Mutual, Allianz and Aviva previously had their appeals dismissed.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

Alcor has also opened an Atlanta office, broadening operations in the US market.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

US events accounted for more than 90% of global insured losses.

-

Category 4 and 5 storms could become more common and hit further north.

-

The start-up aims to bind its first risk in Q4 2025.

-

In the US, the index fell 6.7% year on year.

-

Emilie Hungenberg joins the carrier from Aspen.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Rates continue to drop as capacity is ample, the broker said.

-

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The managing agency is offering 62p per £1 for 2026 YoA capacity.

-

The soft market continued through H1 2025, especially on shared programs.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Premium rose across the top 15 P&C risks in 2024.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

MillerBoost is the latest broker facility to launch in London.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The executive previously spent 15 years in a variety of roles at Zurich.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

CEO Caroline Wagstaff called for a “tailored and proportionate” approach to regulation.

-

The executive’s career includes a stint as head of cat for CorSo.

-

The loss has decreased by 0.3% since the company’s third assessment.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The driver of growth has shifted from rate to volume, as pricing increases tail off.

-

Almost 50,000 people have been forced to evacuate.

-

Plus, the latest people moves and all the top news of the week.

-

Broker facilities and increased US domestic appetite are accelerating the softening.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

Motion Specialty will initially focus on high value home and flood insurance in the US.

-

The revision is significantly lower than the $4.5bn October estimate.

-

The reinsurer said the LA wildfires would have a “dampening effect” on mid-year renewals.

-

The reinsurer's group operating income fell by 14% to EUR480.5mn.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

The facility provides follow capacity to US and international placements.

-

Cat losses included $17.5mn from the CA wildfires and other events.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

The carrier estimated its California wildfire loss at $145mn-$165mn.

-

Co-founder and CUO Jacqui Ferrier has been appointed his successor.

-

Six weeks after the storm, Perils released its first industry-loss estimate at EUR619mn.

-

The only major product line to see rate increases was casualty.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

The firm now reports on insurance exposures to natural perils for 21 countries.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

The announcement comes after similar launches with Inigo and Atrium.

-

The company booked profit for the year of £247mn, up 20% on the prior year.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

Reinsurance made up 12% of the syndicate’s 2024 GWP.

-

Reinsurance and property remained the primary drivers of premium growth.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

The business offers parametric windstorm coverage.

-

The property and specialty insurer reported underwriting profits of $131mn ($170mn).

-

The Italian carrier posted a record group profit of EUR7.3bn.

-

For the prior-year quarter, the carrier reported a EUR9mn loss.

-

Both carriers have extensive reinsurance coverage.

-

Plus, the latest people moves and all the top news of the week.

-

Followers will automatically support primary or excess Inigo quotes.

-

Sources warned of the erosion of underwriting margins after a string of strong years.

-

The London D&F market will shoulder most of the losses.

-

Predicting underwriting conditions for the remainder of the year is ‘challenging’.

-

Several underwriters left Hiscox’s property D&F team last year to join MGA Velocity.

-

North America is likely to be the most financially impacted by the scenario, Lloyd’s said.

-

The London carrier posted an undiscounted combined ratio of 79%, up from 74% in 2023.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

Westfield has seen a number of senior underwriters depart the business in recent weeks.

-

The firm projects losses from the fires at between $160mn-$190mn.

-

Sara Foucher has held roles at RSA, Swiss Re and XL Catlin.

-

The appeals court has ruled that composite policies provide multiple limits.

-

Retention levels for reinsurance fell across the different geographies the carrier operates in.

-

The ratings agency has revised Mercury’s outlook from stable to negative.

-

The group includes James Cooke and Angus Ovens.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

More than 33,000 claims had been filed as of 5 February.

-

The estimate covers property and vehicle claims.

-

Genna Biddell will report to Brad Melvin, president and CEO, BMS Re US.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

Its post-tax estimate of $1.3bn is net of reinsurance recoveries.

-

Underinsurance, total loss claims, and high property values have impacted loss estimates.

-

The annual claims totalled £5.7bn, the largest amount paid out in any year.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The carrier’s Eaton Fire loss would be a retained net loss hit.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

Guy Carpenter said personal-lines exposure would account for 85% of the aggregate loss.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

The broker said disaster data can attract more risk capital.

-

The pool services a number of public authorities in California.