Fidelis Insurance Group

-

It is understood the marine reinsurance programme renewed largely flat.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

Plus, the latest people moves and all the top news of the week.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The new recruit will report to group CUO Ian Houston.

-

Plus, the latest people moves and all the top news of the week.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

How is The Fidelis Partnership choosing to launch into new insurance classes as it rapidly expands?

-

The event was co-hosted by The Fidelis Partnership and IDA Ireland.

-

The carrier said it is disappointed with the English High Court’s decision.

-

She will continue to work with the executive team on key projects and initiatives.

-

The company has settled, or is in the settlement stage, for 80% of the exposure.

-

The Bermudian's first quarter cat losses totalled $333.3mn, compared to $103mn a year ago.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

The MGA will be Pine Walk’s 13th start-up.

-

Jonny Strickle became the group chief actuarial officer for the carrier in 2023.

-

The firm projects losses from the fires at between $160mn-$190mn.

-

The group's reinsurance book was also hit with cat losses during the quarter.

-

In tandem, it pegged its net cat loss estimate from California wildfires at $160mn-$190mn.

-

After one good year, giving back margin now will be “inexcusable”, the executive said.

-

The partnership is Fidelis Insurance Group’s first third-party capacity deal.

-

Cat losses increased 14.6% to $91.6mn, driven by Hurricane Helene and Storm Boris.

-

The marine underwriter said the business had grown through taking “very big positions” on programmes.

-

The IG’s $3.1bn reinsurance tower is facing double-digit pricing increases in the wake of the Baltimore bridge disaster.

-

The announcement comes a week after the launch of international property MGA Seraphina.

-

Kelly Sanders has returned to the Fidelis group to lead the unit.

-

The executive spent 18 years in various finance roles at Arch.

-

Negligence must be proved to cover any loss of life for passengers under P&I cover.

-

The carrier also reported more difficulty than anticipated in realizing the value of collateral following the defaults.

-

The losses were driven by events in property D&F, particularly tornadoes.

-

It will be led by Valeria Del Villano, who was head of international renewables at AIG.

-

The firm has hired from Probitas, Tamesis Dual and Aegis for the cells.

-

Syndicate 3123’s opening is “the largest-ever launch of a Names-sponsored syndicate in Lloyd’s”.

-

The shares are being sold by select shareholders in the group.

-

Along with D&F, Fidelis is looking to grow in marine construction and aviation.

-

The company’s results come less than two months after announcing its Lloyd’s syndicate.

-

Lloyd’s gains leadership, and The Fidelis Partnership gets capital diversification.

-

The syndicate will be Asta managed and have capacity from Hampden Names.

-

The exit comes after Fidelis restructured into two separate firms.

-

The MGU is exploring additional third-party capital relationships.

-

The underwriter was overseeing MGA Kersey Specialty’s pivot to renewables.

-

The firm’s growth focus for 2024 will be in property D&F.

-

The (re)insurer’s Q4 CoR rose 15.2 points to 81.4% on satellite failure, D&F losses.

-

Losses were driven by the Viasat-3 satellite failure, the Sudan conflict and D&F events.

-

The upgrade noted consistent underwriting gains and investment returns, and a CoR below peers.

-

SEC filings show that Travelers’ equity ownership was valued at over $107mn in Q4.

-

The senior energy underwriter exited amid a strategic pivot at the MGA.

-

The Fidelis underwriting unit’s Paul Calnan and Danny Joyce are set to depart.

-

John Symms had been at the firm since 2020 and previously worked at Talbot.

-

The executive’s career includes stints at Acappella and Amlin.

-

The executive will retain his role as European CUO alongside the new position.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The group's third-quarter underwriting income was $74.8mn, compared with an underwriting loss of $89.4mn in Q3 2022.

-

The MGA will be Fidelis MGU subsidiary Pine Walk’s eighth launch.

-

Tomais Gaughan has been promoted to lead the energy offering at SiriusPoint International.

-

The executive said that (re)insurers would need to produce stable and consistent returns before a capital influx.

-

Underwriting income more than doubled to $77.5mn from $32mn as the company grew its top line largely through its specialty segment, reduced reinsurance exposure and lowered catastrophe and large losses.

-

The carrier will aim to reduce its emissions by up to 49% by 2030.

-

Fidelis Insurance Group CEO Dan Burrows and Fidelis MGU counterpart Richard Brindle speak with Insurance Insider after the IPO.

-

The proceeds will be used by the Bermudian to take advantage of rate hardening in key markets.

-

The reaction to capital raising this year signals that investor belief in risk-takers is reinvigorated.

-

Fidelis shares closed down from the $14 per share price set for the IPO, or a 0.8x multiple of its $17.19 book value per share at end of Q1 2023.

-

The carrier stands to raise $210mn from the offering.

-

The increase takes the carrier’s total reserves for the conflict to $145.6mn.

-

The carrier has set its IPO price at between $16 and $19 per common share, and will trade on the New York Stock Exchange under the ticker FIHL.

-

The carrier also recorded a large one-off benefit from the separation of its balance sheet and MGU segments.

-

The carrier cited a “huge” spread of possible outcomes from various lawsuits relating to aviation claims from the conflict.

-

The insurer plans to be listed on the New York Stock Exchange.

-

The Irish subsidiary boosted its top-line growth by 58% during the year as it took advantage of market dislocation.

-

Alignment mechanisms include MGU’s 9.9% stake in balance sheet, personal MGU management stake and a significant profit commission.

-

The senior exits come a matter of months after the business was created in a landmark transaction.

-

The carrier set out a string of defences in the $3.5bn suit.

-

The number of common shares to be offered and the price range for the proposed offering have not yet been determined.

-

Ben Fortune joined Fidelis in 2015 as an underwriter, later becoming head of international reinsurance in 2020.

-

The MGU’s insurance head Richard Coulson said the firm’s ability to offer equity was helping to attract talent.

-

The income figure makes the MGA amongst the largest marine underwriters in London in its first full year of underwriting.

-

The insurance group is being advised by JP Morgan and Barclays Capital.

-

The ratings agency also affirmed the financial strength rating of A and the long-term issuer credit rating of “a” for Fidelis and its subsidiaries.

-

The carrier argued that, because the sum it was being sued for was significant – $95mn in the all-risk case and $240mn in the war risk case – it should be allowed to represent itself.

-

According to sources, Daniel O’Connell will join Fidelis MGU as head of bespoke.

-

Plus our take on the BMS/Eurazeo deal and all the top news of the week.

-

Fidelis MGU will hold a 9.9% stake in the roughly $2bn balance sheet to create alignment, while Richard Brindle and management retain meaningful stakes in both businesses.

-

Matthew Bellamy becomes director of underwriting, while Michael Davern joins the executive committee.

-

Fidelis chairman Richard Brindle said a shift towards named cat perils and away from complex structures is underway, but that carriers need more unity between inwards and outwards teams to navigate the harder market.

-

Mark Noble’s appointment comes two months after he left Liberty Specialty Markets alongside aviation war underwriting manager Mike Hart.

-

The correlation between a good ESG score and low loss ratio is strongest in property insurance, the report shows.

-

Authorities in the UK, Ireland, Belgium and Bermuda have rubberstamped the ambitious restructure.

-

Moves to push down London broker commissions highlights the options open to write reinsurance platforms in other markets.

-

The carrier pushed London brokers for a reduction in the traditional 15% commission.

-

Staff movement remains high in the class of business, which has seen a turnaround in performance.

-

The carrier has put in place further curbs on metallurgical coal, tar sand extraction and fracking.

-

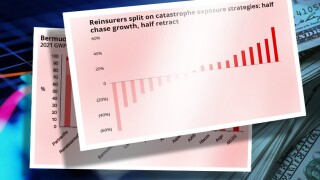

How much capacity is available to meet rising cat reinsurance demands was a key theme throughout this year’s Rendez-Vous.

-

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.