Chubb

-

Tokio Marine HCC, Chubb, IQUW and BluNiche are also on the tower.

-

Patel was recognised for services to charity and Riley for business leadership and inclusion

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

Plus, the latest people moves and all the top news of the week.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Lack of major cat events could add further pressure on 1 January pricing.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Brian Church has spent 20 years at Chubb.

-

-

The carrier agreed to acquire Liberty Mutual’s P&C firms in Thailand and Vietnam in March.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

The claim hits the downstream market following a loss-hit start to the year.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

Philip Enan joins following 11 years at Chubb.

-

The programme will succeed the previous buyback launched in 2023.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

Last year, the firm consolidated financial and excess liability lines under the leadership of Richard Porter.

-

The two Asian companies wrote $265mn net premiums in 2024.

-

Ana Robic will succeed Furby as EMEA regional president.

-

Andy Houston will be based in London, reporting to Mark Roberts, division president UKISA.

-

The carrier has been reducing its exposure to the area where the wildfires occurred by over 50%.

-

New entrants have contributed to competition in the class of business.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

The cargo market has recently seen a string of moves as new carriers launch into the market.

-

The carrier can write marine on company and Lloyd’s platforms after the Probitas deal.

-

The storm caused major damage to one of the drinks company’s warehouses in Tennessee.

-

The CEO said the property market was in a “super-good place”, and increased competition was inevitable.

-

London market carriers may be getting competitive, but that is not in itself a bad thing.

-

The commercial carrier also reported a Hurricane Milton pre-tax net loss forecast of $250mn-$300mn.

-

The CEO noted, however, that the UK retail market remains a big business growing well.

-

Mark Gregory will retire next March, while Sara Mitchell will initially join as a strategic adviser.

-

-

The cyber market should use the latest outage to start decisively taking action on managing cat aggregates.

-

A roundup of all the news you need today, including Lloyd’s chairman candidates.

-

Peter Kelaher currently serves as country president of Australia and New Zealand.

-

It is understood that the executive will report to Scott Meyer, now COO for NA Insurance.

-

Marcos Gunn and Federico Spagnoli have been promoted as a result.

-

A round-up of all the news you need today, including the departure of the heads of FL and PI at Westfield.

-

Arch, Axa XL, Beazley, Chubb, Hiscox, Howden, MS Amlin and TMK are participating.

-

The PVT team will be part of a new crisis management unit under Luke Powis.

-

With the appointment, current division president David Furby will step down from the role.

-

This is Chubb’s second MGA deal in the past few months.

-

Property rates remain adequate, although price increases are tailing off.

-

There is a high likelihood the property claim will be subrogated.

-

The value of the bridge is estimated at $1.2bn.

-

However, it doesn't prove a mutual is a wrong concept for the cyber market.

-

The project is not immediately moving forward due to lack of client demand.

-

This publication revealed Chubb was planning to re-enter the London TL market.

-

Mo joins from Chubb, where she was country manager for Sweden.

-

Strong reinsurance results have absorbed long-tail reserve charges.

-

Chubb withdrew from writing transactional risk in London and all territories outside the US in 2020.

-

The newly created role will see Frederico Spagnoli oversee Chubb’s consumer lines in 51 countries.

-

Chubb declared at the last minute that it would not contest the English court’s jurisdiction, in contrast to every other reinsurer being sued by aircraft lessors.

-

The newly launched offering will cover media liability, cyber, property, terrorism, casualty and legal expenses.

-

At a point when cyber rates are falling and capacity is plentiful in high excess layers, the mutual plans have the wider cyber market somewhat perplexed.

-

Clearer wordings for cyber cat risk would also help foster the development of the more capital-efficient event XoL reinsurance market in cyber, Kessler said.

-

The top five insurers on the continent maintained their ‘clear dominance’ in terms of scale.

-

The consortium is supported by 11 other Lloyd’s businesses.

-

Sources have said the layer will provide the carrier with protection for the Northeast US only and attaches at a remote level.

-

The carrier was originally in the market for extra capacity at January 1 before pulling plans.

-

Edward Kopp will be succeeded in his current role as president of Chubb Korea by Janice (Jae-Kyung) Mo – the first woman to lead a general insurance business in Korea’s history.

-

The CEO said Chubb has ‘never seen better pricing’ on primary property.

-

O’Donnell will focus on strategic and tactical operations within global reinsurance alongside his continuing responsibility for Chubb Tempest Re USA.

-

The cargo market is undergoing staffing turmoil as firms vie to secure talent.

-

The Singapore aviation hub is part of a strategic regional focus for the aviation team from Chubb Global Markets.

-

The executive will be responsible for the growth and profitability of the carrier’s casualty lines in 51 countries and territories outside North America.

-

The executive will have responsibility for lines including property, casualty, professional lines, energy and marine.

-

In early January, the company completed the transactions to increase its position in Huatai to 64.2% from 47.3%.

-

Personnel movement in the class remains elevated as carriers look to secure top talent while underwriting conditions are profitable.

-

Chubb has experienced high turnover within its marine team in the past year.

-

Benoit Chasseguet will be succeeding Veronique Brionne following her decision to leave the company.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

Wayne Ashley will report to Jim Wixtead, senior vice president of Chubb group and president of Chubb Tempest Re.

-

Maria Guercio, Melanie Markwick-Day and Jared Concannon join the unit as executives.

-

Evan Greenberg addressed questions about property cat reinsurance on a Q1 earnings call.

-

Excluding agriculture, Chubb’s P&C CoR rose to 85.9% in Q4 from 85.4% the prior-year quarter.

-

Chris Collins will report into Simon Abbott in his new role, and will help the carrier expand its airline portfolio.

-

The hire comes after the carrier recently appointed AGCS’ Chris Turberville to lead the hull team.

-

New demand for reinsurance cover that was expected to come to the market around the January renewals is being reined in as insurers recognise the extent of the hardening market.

-

Alex O’Brien succeeds David Kirk, who retained his cargo product head responsibilities following his promotion to head of marine in July.

-

Analysts said attachment points are now far behind the rate of inflation over the period.

-

Prior to approval, the commercial carrier owned 47.3% of the Chinese insurance group.

-

Sources said Miami-based Everest fac VP Sean Berry is set to move to London as head of international property.

-

Chubb has seen several exits from its marine team this year and restructured its leadership.

-

The insurer takes a $1bn retention on US losses but could have made some reinsurance recoveries.

-

With significantly lower retentions, AIG, Assurant and Allstate are more likely to pass the cost of the hurricane onward to their reinsurers.

-

The appointment comes following the departure of Renette Pretorius, who is joining Berkshire Hathaway Specialty Insurance.

-

The executive has worked at the carrier for over nine years, initially within the accident and health team.

-

Josh Hearnden becomes the second recent acquisition to the Mosaic PV team of late, following the news in May that Luke Bennett was joining from WRB Underwriting.

-

In his new role, Martin Audis will be based in London and will report to Nigel Griffiths, regional head of general aviation.

-

The investor will manage a portion of the Bermudian’s assets.

-

The market is taking its first proactive steps to resolve issues posed by the massive systemic exposures it is running.

-

The resignations follow the exit of hull chief James May, who is joining Convex.

-

David Kirk will oversee CGM’s marine portfolio underwritten in the London wholesale market.

-

QBE Europe’s UK surety manager Tom Johnson is leaving the company and looks set to join Chubb, Insurance Insider can reveal.

-

Shareholders approved a second proposal asking for a report detailing how Chubb is addressing greenhouse gas emissions.

-

Plus this week’s Q1 results and all the top news of the week.

-

The carrier split its specialty composite treaty into two contracts to get its programme home.

-

The carrier has extended the limit to $1.275bn for the year to 31 March 2023.

-

The figure was partially offset by $15mn of pre-tax unrealized gains, bringing a total net realized and unrealized loss of $58mn.

-

Conditions for SPAC D&O are likely to remain turbulent, amid the heightened SEC scrutiny and uncertainty concerning claims resolution.

-

The new lead underwriter has almost 30 years’ experience including stints at Chubb, Faraday and Howden.

-

Chubb has also received demands from shareholders for more information on its climate-related policies.

-

The appointment comes after Allison Wilkinson departed Chubb to join Convex.

-

The insurer expects to close the transaction during 2022 upon Chinese regulatory approvals.

-

The senior underwriting figure will lead one of the bigger aviation portfolios in the London market.

-

Nathalie Meyer, Nikolay Dmitriev and Christian Graber have been promoted to fill Dawn Miller’s shoes, was she leaves to join Lloyd’s as commercial director.

-

Based in London, Janet Edey will be responsible for developing Chubb’s financial lines business in the UK, Ireland and South Africa.

-

Chubb has promoted Emma Walker to the head of aerospace role for Chubb Global Markets, giving her responsibility for managing and developing the carrier’s global aerospace portfolio.

-

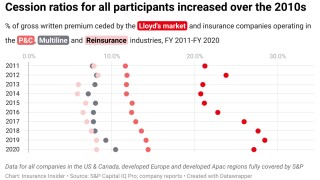

Analysis of financial data shows that the last decade has seen a marked increase in the proportion of premiums ceded by carriers in all sectors.

-

The transaction will near-double the size of Chubb’s A&H book and increase its Asia premium from $4bn to $7bn.

-

The former South Africa A&H head will return to London for his new role.

-

Nazir boasts 20 years of industry experience, and has served at Chubb for nearly four years.

-

Nine (re)insurance firms in London took part in the programme for career-break women, organised by diversity and inclusion firm Inclusivity and supported by the Insurance Families Network.

-

Convex has been building out its FI team, which is headed up by Allison Hollern.

-

The surge likely reflects talk in the buy-side community fuelled by tracking the latter's private jet.

-

Industry veteran Hilda Toh has been promoted to oversee P&C strategy for the three countries, after her predecessor Mark Roberts was given the division president role.

-

Poliquin will oversee product, business development, underwriting operations, and overall profit and loss performance for Chubb’s property and casualty businesses in Latin America.

-

Chubb names Ben Campey and Chris Templeton as senior managers for its United Kingdom and Ireland casualty team.

-

The carrier has also promoted Sara Mitchell and Mark Roberts to top Emea roles.

-

Staff movement has been high in the sector, as new capacity returns to the market after years of correction.

-

Nicholas Hawkins, Chubb’s Peter Kelaher and Munich Re’s Scott Hawkins take director roles at the Australian industry organisation.

-

The Chubb CEO seeks to quash speculation the carrier may return with a sweetened takeover proposal.

-

Plus in-depth analyses of the accident and health and airlines markets.

-

Chubb reiterates its disappointment about The Hartford’s refusal to engage.