-

Zurich’s interest in a specialty carrier that moves the dial on cyber is no surprise.

-

Following on from Part I, we look at the hazards to navigate in building internationally from Lloyd’s.

-

Chaucer and Beazley are among the syndicates looking to take on new geographies.

-

CRC and Alliant are among those investigating the potential for new vehicles.

-

Carrier M&A will continue to be a feature, as pressure for returns on AI investment ramps up.

-

Insurance Insider looks at key drivers of supply-demand dynamics in global specialty markets.

-

The renewal was characterised by abundant capacity and strong competition.

-

The pricing battle has been played out but the extent of new demand will only show up in 2026.

-

Insurance Insider reflects on the themes that shaped 2025 for the London market.

-

Market participants on programs/MGU business in particular feel there's more capacity than 12 months ago.

-

Insurance Insider reflects on major loss events of 2025 for the London market.

-

Cedants are opting to bank double-digit savings as reinsurers fight for market share.

-

Market sources have also raised the prospect of moving the market beyond bureau reliance.

-

Transactions reveal the attractiveness of the "underwriting plus" business model.

-

Nearly one-third of 2025’s talent movement was recorded in Q3.

-

As demand rises across the digital asset space for multiple forms of crypto-related insurance, competition is building.

-

PE, more alignment and tech are uncoupling MGAs from traditional market swings.

-

A look back at the year in (re)insurance, with the aid of some of our visual journalism.

-

Beazley, Hiscox and Lancashire executives spoke 12k words on average in 2025 earnings calls.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

Expectations that reductions would cap out at low double digits are fading due to capacity oversupply.

-

All-risks premium increases are now understood to be in the 15% to 20% range.

-

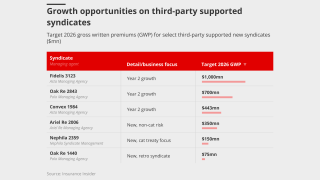

Smaller syndicates are lifting their share of the market, as the top quartile also returned to growth.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Six of the 10 largest syndicates remained flat or reported de-emptions.

-

Lower rates and currency shifts have pushed syndicates to cut stamp.

-

The carrier is looking to latch onto emerging economic trends where it can add expertise.

-

Most segments have grown premiums so far this year, but only three have observed increased rates.

-

In this final instalment, we argue that investing in personnel is as critical to success as the tech itself.

-

Willis reports that the mining market has softened at a ‘considerable rate’ this year.

-

Aegis, Beazley and others are among those cutting stamps.

-

At our London conference, executives saw various routes to growth, even as headwinds grow.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

Several PE-backed syndicates were recently sold, but some of the fastest-growing businesses remain up for grabs.

-

From top-line challenges to finding new ways to scale, 2025 has been a year of market shifts.

-

Property growth plans are cooling, but favourable loss trends will increase surplus capacity.

-

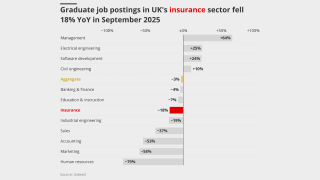

Industry-wide initiatives continue to target expanded youth access to the sector.

-

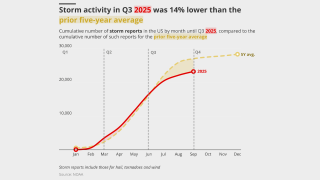

Lack of major cat events could add further pressure on 1 January pricing.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Carriers are rethinking the traditional renewal-rights model.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Several airlines are understood to have come to market early.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

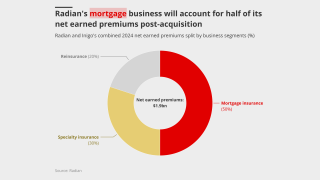

The deal will be watched closely by Radian’s handful of similar peers.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.