AJ Gallagher

-

The broker has analysed the differences in wildfire risk between Northern and Southern California.

-

Georgina Meyer joins the broker as executive director of UK property.

-

Further rate increases are anticipated through 2026.

-

-

The recruit is expected to take on a role at the WTW/Bain Capital start-up after sitting out a year of gardening leave.

-

Gallagher’s $13.45bn deal for AssuredPartners was completed in August.

-

Tom Wakefield says there is scope for opportunistic reinsurance purchases in 2026.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

He will join Gallagher as chief broking officer for EMEA transaction solutions.

-

Clive Strickland previously worked at Gallagher, where he had been a partner since 2020.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

The energy broker’s career also includes a stint at Price Forbes.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

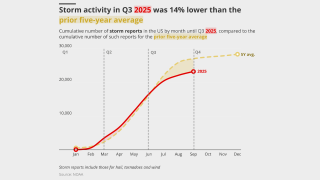

Though wildfire losses are up, total losses are the lowest since 2015.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

Plus, the latest people moves and all the top news of the week.

-

The change in reinsurance intermediary follows an RFP for the account.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

Strong CoRs and investment returns supported profitability in H1 2025.

-

The broker said it was achievable to place a $2bn vertical limit in the London market.

-

Bartlett is the latest in a series of talent moves in the construction market.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

The broker said that there could be a flattening of rate decreases in the hull market in 2026.